The best crypto exchanges in Russian. The best Russian-language cryptocurrency exchanges

– a generalized name for virtual (digital) currency. This coin is protected from counterfeiting as it contains encrypted information. As a result, today it is one of the most popular types of electronic money. Many mining exchanges, in addition to trading, offer their exchange services at favorable rates. But how to make the right choice among a whole variety? Cryptocurrency exchange: the monitoring carried out allows us to draw the following conclusions.

Exmo cryptocurrency exchange: review, wallet, exchange, withdrawal of money

Poloniex - review. How to work. How to trade cryptocurrency.

Three Chinese leaders

Prominent representatives and giants of both the international and Chinese Bitcoin markets are:

Cryptocurrency exchange btcchina.com

btcchina.com – the Chinese Bitcoin cryptocurrency exchange is in first place in the world in terms of trading volume.

The main features of working on this platform are:

- providing complete user information in accordance with Chinese laws;

- HKD, CNY, USD are withdrawn and deposited;

- availability of a cryptocurrency exchange service and payment system;

- commission is 0.3%;

- absence ;

- the commission for transactions within the system is lower than on other electronic wallets;

- language support only in Chinese;

Okcoin.com

Okcoin ranks second in the list of Chinese cryptocurrency exchanges. Was founded in 2013 in Beijing. Has more than 120,000 active users. In addition, it is rightly called the leader of the payment infrastructure. Among the main features of her work it is worth noting:

- To withdraw funds, you must go through identification;

- Bitcoin exchange rate allows you to trade derivatives and make profitable exchanges for USD with further withdrawal to bank cards and money transfers;

- there is the possibility of margin trading;

- there is no commission;

Huobi.com

huobi.com or BitYes ranks third in the world in the list of Bitcoin exchanges in terms of trading volume. In addition, it is developing at a rapid pace, saturating its range of services with new operations and interface modifications. As a result, in 2014, a trial version of com was released, on which btc and ltc are traded for usd. The main features of the work include:

- user authorization is considered completed after providing email and personal data;

- works with dollars through the Hong Kong offshore system;

- the commission is minimal;

- there is an API;

- This platform supports Chinese and English languages;

- In addition, the withdrawal of virtual funds is carried out automatically;

- The support service works via email or Skype.

Chinese cryptocurrency exchanges have held the leading market positions in their hands for several years in a row. However, the rapidly growing Japanese BitFlyer was well invested by the state this year and is now a worthy competitor to the Chinese three.

As a result, analysts in their forecasts do not exclude the possibility that very soon the market primacy will pass to the Japanese creation.

The exchanger is needed by those who want to withdraw money to fiat as quickly as possible, but at the same time they will have to put up with possibly high commission fees, and the exchange rate can rarely be profitable.

On trading platforms it’s different. Crypto exchange

- a trading platform that allows you to carry out exchange operations on any asset available in the functionality (depending on the selected one) and all these operations are carried out between participants.

Its role is only to bring people together and ensure a safe exchange of funds. Also, the advantage of trading on such a project is that you can always wait for a favorable opportunity

to make a purchase/sale at the best offers. Which crypto exchange to choose in 2018?

For beginners, it is better to start with one that supports the Russian language, so that, at a minimum, you can read all the trading rules and working conditions.

The most popular cryptocurrency exchanges of 2018

From this article you will learn exactly how to choose a cryptocurrency exchange in Russian from those available on the market today.

Below is a description of the most popular ones for 2018, which have made themselves known and deserve to become your No. 1 choice.

EXMO The first and, quite possibly, the most convenient Russian-language crypto exchange is .

EXMO

The management of the provost has tried to optimize the work as much as possible and the service has a lot of options for depositing and withdrawing funds. Except USD, EUR, UAH, PLN and RUB

from bank cards and transfers, there is the possibility of transactions through electronic wallet gateways:

Withdrawing money from the crypto exchange to bank cards and transfers, as well as, is carried out with the condition of additional confirmation of the investor’s identity (profile verification).

The general commission fee on Eksmo is 0.2%, which is the market average.

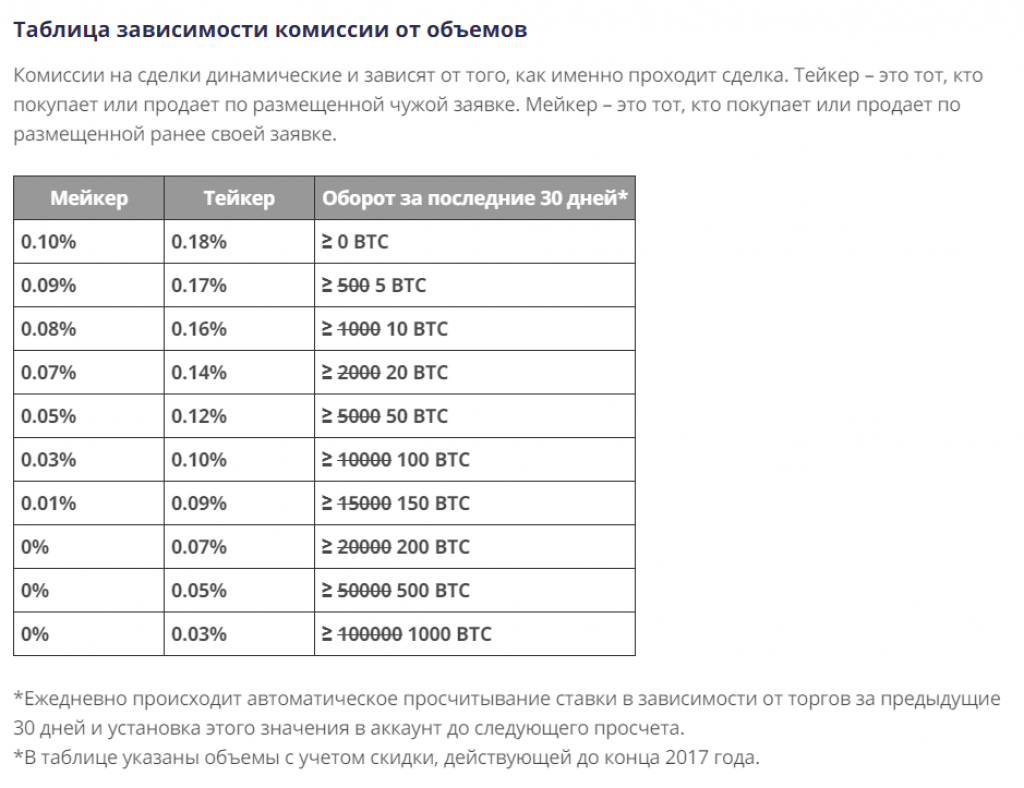

For active crypto investors, there is a system of reducing commissions depending on the trading volume.

Another special feature of EXMO is the availability of cashback - refund to the account of part of the commission paid for the month.

BitFlip

This site appeared quite recently, but the company has earned itself some loyal audience.

Trading is carried out on popular crypto coins, and there are also some less common ones, for example, , R.M.C..

There is its own exchange token Flip.

One of the attractive features of BitFlip is that the commission changes depending on activity, reaching 0%!

By increasing the trading turnover, the cost of the fee for closing orders will decrease, and for pending orders with trading above 1000 BTC - be absent altogether.

Account replenishment is carried out according to a fairly wide list:

Also, a fairly young but ambitious crypto exchange, which opened only in 2017, confidently takes its place among the best.

For now - largest.

The crypto service is based in Hong Kong and is subject to local laws.

The idea behind the creation was to orient the crypto service to the requirements of today’s market.

It is capable of processing a large number of transactions simultaneously.

But even during the boom in closing registrations of new crypto users, it temporarily stopped “launching” newcomers.

The margin is relatively low, only 0.1%, but with all this, the security of transactions is guaranteed on the project and this wins the trust of a large number of investors.

In addition, the site interface is well adapted for use on a mobile device.

The number of types of coins is extensive and more are added every day.

Like BitFlip, Binance has its own development - BinanceCoin (BNC), which consists of circulation only within the service itself and is intended to create additional privileges for holders.

It is more profitable for BNC to pay margin, because instead of 0.1%, when paying using BinanceCoin, the commission will be 0.05%.

The constant growth of the exchange coin rate is another advantage of the holder.

There is good news for beginners and small investors– Binance does not require mandatory verification, because without it the daily withdrawal amount is 2 BTC.

For holders of a large investment budget who plan to withdraw up to 100 bitcoins per day, verification is necessary.

BitMEX

The BitMEX company is based in Hong Kong, it is official and focused on active trading and making money through speculative means.

Interface support in Russian appeared relatively recently, so it is just beginning to gain new clients in the Ru-segment.

LocalBitcoins

One of the crypto exchanges adapted for Russian-speaking citizens.

The principle of operation is absolutely different from others, because there is no function for depositing/withdrawing funds.

Instead, the exchange is made through a third party.

All actions are done manually.

That is, after choosing a transaction that is suitable for the terms of the transaction, the client must make a payment using the specified payment details and then wait for some time for the return payment.

And many may not understand what is the point of using this kind of project for trading, if there are many other, more optimized options.

However, the point is that This platform allows you to send Bitcoin to the most important payment system for a crypto trader or in the currency of the country where the recipient is located.

But the reliability of a participant can be assessed by the number of successful transactions he has conducted.

The platform is local because it is the only one of its kind that places transactions for exchanging crypto coins for cash.

A modern and practical crypto platform with an excellent interface.

Registered in Hong Kong and is popular, however the big disadvantage is the rather passable translation of RU.

But using the service in English is quite comfortable.

Recently its daily trading turnover increased to several hundred million dollars.

And continues to gain the trust of crypto traders, taking rapid steps towards success.

Presented cryptocurrency platforms– conditionally without verification for withdrawal of funds (if you do not take into account bank fiat).

Which platform to choose for trading It's up to you to decide.

Read about the largest crypto exchanges in the world in a separate article.

Shanghai Stock Exchange (SSE) is rightfully considered one of the important symbols of China’s rapidly growing economy.

Created relatively recently, in 1990, today it is confidently one of the ten largest trading platforms in the world, occupying, according to various sources, 4-7 places. This is logical and easily explained by the fact that the volume of GDP of the People's Republic of China, according to many analysts, already exceeds that of the undisputed leader of recent decades - the United States.

It is important to note that the Chinese government is pursuing a strict financial policy aimed at seriously limiting the influx of financial resources from foreign investors. Otherwise, the position of the Shanghai Stock Exchange in the world market would be even more impressive.

The Shanghai Stock Exchange is the largest platform for trading shares and other types of securities in the People's Republic of China (PRC). The English name of the organization is as follows - Shanghai Stock Exchange or abbreviated SSE. The Shanghai Exchange, together with the Shenzhen Exchange, which is slightly inferior in turnover and number of traded shares ( SZSE), are two independent exchanges located in mainland China.

The main financial instruments used on the largest Chinese stock exchange are stocks and bonds, as well as various stock indices. It is important to note that shares are divided into two categories, one of which is priced and traded in RMB, and the second in US dollars.

The Chinese Stock Exchange is located in the largest city in the country, and according to some sources, in the whole world, Shanghai. The official address in English is: 528 South Pudong RD., Shanghai, 200120, PR China.

Official site

Official website of the Shanghai Stock Exchange: http://english.sse.com.cn/.

Shanghai Stock Exchange opening hours

Trading on the SSE takes place from Monday to Friday. The opening hours of the Shanghai Stock Exchange include two trading sessions:

- the first lasts from 9.00 to 11.00 Shanghai time (it is 5 hours ahead of Moscow);

- the second starts at 13.00 and continues until 15.00.

Between sessions there is an hour and a half break, traditionally called a lunch break. Preparation for trading is carried out from 9.15 to 9.25.

SSE Owners

The Shanghai Stock Exchange is a non-profit organization. It is under the direct and immediate control of a government agency of the People's Republic of China called the Securities Commission.

Bidders

The Chinese stock market is under strict government control. Therefore, until 2002, access to the Shanghai Stock Exchange was closed to the vast majority of foreign investors. Even after most of the restrictions were lifted, the division between stocks traded in dollars and yuan remained.

The best brokers for investing in stocks

- eToro

The broker offers a huge number of shares. Most brokers strive to provide access only to the most popular NYSE or NASDAQ, but FinmaxFX has a huge number of European and Asian stocks, a large number of indices, and of course, securities from American exchanges, including domestic companies. The broker provides a professional trading platform and the best conditions.

Adjustable VFSC and in Russia TsROFR. Recommended initial deposit $250-300 .

Official site:

Owned by a broker who has been in business for over 20 years. The platform itself is under the control of European regulators CySEC And MiFID. Here you will find a huge number of stocks, stock indices, ETFs and more.

The broker offers a huge asset base, an academy (training programs), constantly conducts webinars, provides analytics and has a very convenient trading platform to which a large number of indicators are connected. The platform itself has a block with the latest news and forecasts in Russian. Minimum deposit $200 .

Official site:

History of creation

Despite the fact that the Shanghai Stock Exchange was officially created only in 1990, namely on November 26, the securities market in China appeared much earlier, which is quite natural, given the size and population of this far from the smallest country. However, before describing the stages of formation of the stock market, attention should be paid to some state features of its formation, which were reflected in the modern work of both the SSE and the second trading platform of China, SZSE.

Despite the fact that the Shanghai Stock Exchange was officially created only in 1990, namely on November 26, the securities market in China appeared much earlier, which is quite natural, given the size and population of this far from the smallest country. However, before describing the stages of formation of the stock market, attention should be paid to some state features of its formation, which were reflected in the modern work of both the SSE and the second trading platform of China, SZSE.

For a long time, the stock market in China was formed along a similar path to other Asian countries, similar in terms of the level of development of the financial sector of the economy. However, first during the period of occupation by Japan during the Second World War, and then after the Communist Party came to power in 1949, all exchanges operating at that time were closed. This situation continued until the first half of the 80s of the last century, when there was a serious shortage of financial resources necessary for the further development of the country’s rapidly growing economy.

The result of this situation was the issue of bonds by the Government of the People's Republic of China, which became a kind of signal for the revival of the state's stock market. Over the next few years, the proven fundraising scheme was put into action several times. Together with the rapid growth of the economy, this became one of the main reasons for the emergence of the Shanghai Stock Exchange in its modern form.

Shanghai Stock Exchange from the inside

Main stages of development of the Chinese stock market

- 1842 The signing of the Treaty of Nanjing as a result of the first Opium War, which allowed foreigners to take part in the Chinese economy.

- 1866 The emergence of the first securities transaction registrar in China.

- 1891 Opening of the first trading platform called the Shanghai Stock Brokers Association, where shares of mining companies were traded.

- 1904 Official registration of the site as the first Shanghai Stock Exchange in China.

- 1929 Acquisition of several smaller trading platforms by the Shanghai Stock Exchange.

- 1930 SSE's leading position in the financial market of the Far East.

- 1941 On December 5, the exchange ceased operations due to the events of the Second World War and the occupation of a large part of the country, including Shanghai, by Japan.

- 1946 Resumption of the Chinese stock market and exchange activities after the end of the Japanese occupation.

- 1949 The closure of stock exchanges and the stock market as a whole was decided by the Chinese Communist Party, which came to power.

- 1981 Resumption of trading in government bonds.

- 1984 Opening of trading in securities of various Chinese companies in several major cities, including Shanghai.

- 1986 It opens in April, and it only has an impact on the Chinese market in 1997, when Hong Kong officially becomes part of the PRC.

- 1990 On November 26, the Shanghai Stock Exchange is created, which begins work within three weeks, that is, on December 19.

- 1991 The second China Stock Exchange opens in Shenzhen in December. SZSE.

Interesting fact. The Shanghai Exchange is one of the few and the only large similar organizations that did not stop working for a single day even during the global financial and economic crisis of 2008-2009.

Current SSE position

Today, the Shanghai Stock Exchange is considered one of the undisputed market leaders, occupying, according to various estimates, 4-7 place among the world's largest securities trading platforms. This was a consequence of the rapid development of the Chinese economy in the last 4 decades, which led to the logical and no less rapid growth of the country's stock market.

Development of SSE in recent years

However, the beginning of the 21st century was quite problematic. Between 2001 and 2005 there was a fairly serious decline in the market, which came as a surprise after many years of growth.  As a result, in April 2005, a ban on new IPOs was introduced, which made it possible to somewhat reduce tension in the market and resolve existing problems through securities already put into circulation. As a result, in May 2006, SSE resumed full operations, and the ban on IPOs was lifted.

As a result, in April 2005, a ban on new IPOs was introduced, which made it possible to somewhat reduce tension in the market and resolve existing problems through securities already put into circulation. As a result, in May 2006, SSE resumed full operations, and the ban on IPOs was lifted.

However, already at the beginning of 2007, namely on February 27, Tuesday, later nicknamed “ black", one of the main indexes collapses SSE Shanghai Composite by 9% in one trading session. Such a serious drop in the Chinese stock market was reflected in many trading platforms around the world. The consequence of this was significant adjustments in the work of the Shanghai Stock Exchange and the Chinese stock market and other types of securities in general.

Interesting fact. According to financial analysts, one of the main reasons for the collapse that occurred on February 27 was the words of the deputy speaker of the country's parliament, Zheng Xiwei, about how dangerous it is to further inflate the “stock bubble.”

As a result, in 2007-2008, the country's market experienced a period of so-called stock madness, associated with another period of rapid growth, and the SSE at some periods became the second largest trading platform in the world, second only to the undisputed leader - the New York Stock Exchange.

The number of broker clients officially registered in China at the beginning of 2007 was over 80 million people. In other words, more than half of the Russian population traded shares on the Chinese stock market.

Even after the onset of the global economic crisis, China in general and the Shanghai Stock Exchange in particular did not lose their positions. To confirm these words, it is enough to provide the following figures:

- in 2006, the Industrial and Commercial Bank of the People's Republic of China carried out an IPO on the SSE worth $21.9 billion;

- In 2010, the Agricultural Bank of China IPO took place on the SSE, the value of which exceeded $22.1 billion.

Before the $25 billion listing of another Chinese giant on the NYSE in 2014, these were the largest IPOs in the history of the global stock market.

Of the three largest IPOs to date, all three were from Chinese companies, with two of them on the Shanghai Stock Exchange.

However, even such a powerful and developed economy as China has developed can experience serious problems. Another proof of this thesis was the recent collapse on the SSE, which occurred on February 25, 2016. On this day Shanghai Composite Index fell immediately by 6.4%, which, naturally, immediately affected the global stock market as a whole.

Exchange functions

The peculiarities of the functioning of the Chinese financial and economic system have led to the fact that the Shanghai Stock Exchange performs, in addition to traditional ones, functions that are not quite usual for such an organization. These include:

- retention of capital within the country through the development of the country's stock market;

- regulation of relations between participants in securities trading;

- effective redistribution of financial resources available within the state and coming from outside;

- restriction of access to the Chinese stock market and, as a consequence, the ownership of Chinese enterprises by foreign investors.

Obviously, taking into account all that has been said, it is quite difficult to call the stock market that has developed in China fully market due to serious government control and existing restrictions on the inflow of capital from abroad. However, this does not prevent the country’s economy from developing successfully, despite periodic market collapses, which not a single state, even the most financially developed, has escaped.

Main financial indicators of activity and position of the exchange in the world

One of the features of the Chinese stock market, which equally applies to other areas of the economy, is the fairly serious secrecy of a significant part of the information. Therefore, in various sources, data on the performance of SSE and, as a result, its place in the global stock market differ significantly.

So, on the official website of the exchange itself the following figures are given:

- the number of companies that have undergone the listing procedure is 1334;

- place in the ranking of stock exchanges by market capitalization – 4;

- place in trading turnover – 4th.

According to information from other sources, it follows that the number of companies that successfully completed the listing procedure increased to 1182. At the same time, the capitalization of the exchange amounted to ¥28.5 trillion. (approximately $4 trillion.), and the daily trading turnover reaches ¥205.6 billion. (approximately $29.54 billion.)

In any case, we can say with confidence that the Shanghai Stock Exchange is one of the 5-6 largest trading platforms in the world, and its position is likely to become even stronger in the coming years.

Based on Wikipedia data and official information posted on the websites of the largest exchanges, the following picture emerges. The New York Stock Exchange ($19.2 trillion) leads by a fairly large margin in terms of total capitalization, 2nd-3rd place is occupied by NASDAQ and the London Stock Exchange ($6.8 and $6.2 trillion, respectively), and from 4th to 6th to 6th place is occupied by the three largest Asian trading platforms - the Tokyo, Shanghai and Hong Kong stock exchanges (respectively, $4.4 trillion, $4.0 trillion and $3.3 trillion).

Shanghai Stock Exchange indices

The main indicator of the activity of SSE is. Another frequently used name for this indicator, one of the most important indicators for the entire global stock market, is Shanghai Composite.

It was developed approximately six months after the modern opening of the exchange, that is, July 15, 1991. The calculation is based on the price dynamics of all shares of companies traded on the stock exchange. Less popular and well-known is another index - SSE 50. It is calculated based on data on the share price of 50 companies with the largest capitalization.

Listing on SSE

| Company | Industry |

| Sinopec | Oil & gas |

| China Southern Airlines | Airline |

| China United Network Communications | Telecommunication |

| Sinolink Securities | Financial services |

| Kangmei Pharmaceutical | Pharmaceutical |

| AVIC Aviation Engine | Aerospace |

| Daqin Railway | Rail transport |

| China Shenhua Energy | Energy |

| Industrial Bank | Banking |

| Bank of Beijing | Banking |

| China Railway Construction | Construction |

| Ping An Insurance | Insurance |

| New China Life Insurance | Insurance |

| PetroChina | Oil & gas |

The SSE imposes extremely stringent requirements on companies wishing to list on the exchange, which are rightly considered to be among the most difficult to meet compared to other major trading platforms in the world. In particular, in order to offer shares or other securities for trading, the applicant company must:

- have been operating profitably for the last three years;

- have a capitalization of ¥30 million (almost $4.6 million);

- have 1000 shareholders;

- if the share capital is ¥400 million or more, at least a quarter of this amount must be placed on the SSE.

The most active listings on the Shanghai Stock Exchange are, quite naturally, Chinese companies. It is important to note that approximately 80% of them are fully or partially government-owned.

Such indicators once again clearly demonstrate how specific the Chinese economy is and is not similar to other developed economies of the world.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

On this page we have collected all the necessary information for a novice crypto trader - below you will find our rating of cryptocurrency exchanges , which was compiled with the help of experienced traders, as well as answers to frequently asked questions, educational materials and tips to help you decide on which exchange to choose and how to get started in the world of cryptocurrency trading.

All information in the article is relevant for 2019 and is constantly updated , so you can be confident in its authenticity.

To quickly jump to the section you are interested in, use the table of contents:

Best Cryptocurrency Exchanges - TOP 10:

1. Binance is the world's largest crypto exchange!

The Binance exchange opened in 2017 and already in 2018 became the largest exchange in the World in terms of trading volume and number of users. Thus, in less than a year, this exchange has surpassed in popularity all other trading platforms that have been operating for years! Now the exchange is consistently among the top 10 largest cryptocurrency platforms in the World.

Binance has gained such popularity due to the fact that one of its founders is the creator of the BlockChain service (I think everyone who has worked at least a little with cryptocurrency is familiar with this service), and also due to the fact that this exchange has enormous functionality , which will satisfy even the most picky trader.

Main features of Binance:

- The largest and most reliable cryptocurrency exchange in the world.

- A large number of trading pairs - more than 200 and new ones are constantly being added.

- Huge functionality, everything you need for comfortable trading.

- Operational tech. support.

- Low commission for trading - only 0.1% (and you can also get a 20% discount!).

- Recently you can top up your exchange account with a plastic card!

2. EXMO is the best Russian cryptocurrency exchange.

In the name of the exchange, I indicated that it is Russian, but this is not entirely true - rather, it is the largest Russian-language exchange, because at the moment there are no completely Russian cryptocurrency exchanges (which would be created in Russia and work only with Russian users).

But EXMO is an exchange that is primarily focused on Russia and the CIS countries - according to one of the latest reports provided by the exchange itself, the number of Russian-speaking users on EXMO is more than 50%.

This is achieved due to the fact that EXMO works with a large number of fiat currencies, which are convenient for users from the CIS - such as WebMoney, QIWI, Yandex. Money and others. And also, EKSMO is completely, and most importantly - qualitatively, translated into Russian, so even if you do not know foreign languages, you will not have any problems with working on this exchange.

Thus, if you just have WM / QIWI / YAD and want to purchase cryptocurrency, then EXMO will be an excellent choice for you.

Main features of EXMO:

- The largest and most reliable cryptocurrency exchange in Russian.

- There are a sufficient number of cryptocurrencies - about 50, new ones are added periodically.

- The exchange interface is as simple and intuitive as possible - even a beginner can figure it out.

- Operational, 24/7 technical support. support in Russian.

- The average commission for trading is 0.2%.

- No identity verification is required and you can trade anonymously.

- Large selection of fiat currencies for depositing and withdrawing from the exchange - WebMoney / QIWI / Yandex Money and etc.

3. LocalBitcoins – convenient cryptocurrency exchange.

LocalBitcoins is not a completely standard exchange. This trading platform is something between an exchange and a cryptocurrency exchanger. It's all about how trading takes place on this site:

And they go according to the following scheme - anyone can post here their “ad” like this: “I have 1 Bitcoin and I am ready to sell it at a certain rate for Rubles on a Sberbank card” (for example). As you can see, on LocalBitcoins, each user can submit his offer to buy or sell cryptocurrency for the currency he needs and at the rate he wants - this is as convenient and simple as possible.

Although the platform is international, it is also quite popular in Russia (and the CIS), so there are a large number of offers for buying/selling cryptocurrencies. Hence, there is a large selection of currencies for payments - you can always buy or sell cryptocurrency on this exchange, no matter what currency you use: from a Sberbank card, from Tinkoff/Alfa Bank, or for any electronic money - WebMoney, QIWI, YaD and others .

Main features of LocalBitcoins:

- Large and convenient international exchange.

- Works with practically any fiat currencies and cryptocurrencies !

- The most simple and understandable process for buying/selling cryptocurrencies.

- Operational tech. support.

- High commission for trading - 0.5%.

- No identity verification is required and you can trade anonymously.

4. KuCoin is a new and already popular exchange.

Another very high-quality exchange, which is primarily aimed at traders. It has everything you need - a large selection of cryptocurrencies for trading, low trading commissions, a mobile application for those who want to trade not only from their home computer, and much more.

Due to all of the above, this exchange quickly gained popularity. It opened in 2017, and now already occupies one of the leading places in the world in terms of trading volume.

Main features of KuCoin:

- A large number of cryptocurrencies for trading (more than 300).

- 24-hour operational technical support. support.

- Low commission for trading - 0.1%.

- No identity verification is required and you can trade anonymously.

5. LiveCoin is another cryptocurrency exchange in Russian.

Perhaps this is the second cryptocurrency exchange in terms of trading volumes, which is aimed at users from the CIS countries - here, as well as on EXMO, everything is perfectly translated into Russian, and the exchange interface is simple and clear, so there are no problems with working on this exchange it shouldn't happen to you.

In principle, this is a “smaller” analogue of the EXMO exchange, which we discussed above. Just like EXMO, this platform works with fiat currencies that are convenient for users from Russia, for example QIWI .

There are two main differences between this exchange and EXMO: firstly, there are fewer users and less trading volume, so if you are an active trader and are going to make money by trading cryptocurrencies, it is better to choose a larger exchange. Secondly, there are noticeably more different cryptocurrencies traded on LiveCoin - so if you haven’t found the cryptocurrency you need on EXMO, then it makes sense to try this exchange.

Main features of LiveCoin:

- A simple and convenient exchange in Russian.

- Intuitive interface.

- Operational tech. support.

- The average commission for trading is 0.18%.

- No identity verification is required and you can trade anonymously.

6. Poloniex is a large international platform.

The Poloniex exchange is one of the largest cryptocurrency exchanges in the world, both in terms of trading volume and number of users.

This exchange has a very decent number of trading pairs, and also implements all the functionality necessary for a serious trader - in general, an excellent choice for professional traders.

But this exchange also has a rather big disadvantage - to work on it, identity verification is required. That is, it will be necessary to send to those. exchange support various photographs (passports, you yourself holding a passport, etc.), and also be sure to indicate your real data (name, address, etc.) in your profile: without this, you simply will not be allowed to perform any actions on the exchange - it will not be possible even top up your balance or withdraw money from the exchange if you do not confirm your identity.

Therefore, if you have no desire to undergo verification (and passing it is not so easy), then this exchange is not for you. If verification doesn’t bother you, I recommend trying this exchange.

Main features of Poloniex:

- Large international exchange for experienced traders.

- A large number of supported cryptocurrencies (more than 100)!

- Operational tech. support.

- Identity verification required!

7. CEX is a popular exchange all over the world.

This trading platform is one of the most famous in the world, because... It has been running since 2013 and has a huge number of users.

CEX began its activities as an exchanger rather than as an exchange, and in general it was not far from being an “exchanger”. Because until now, only about ten of the most popular cryptocurrencies for trading are available on this site. Thus, this exchange is most likely not suitable for a serious trader, but if you just want to buy or sell cryptocurrency, then you can do it on CEX.

There is also another sad feature of this exchange, which is that in order to trade you need to confirm your identity - that is, go through verification (as on the previous exchange you will have to send copies of your passport, etc.).

The truth here is that everything is not so strict - without verification you can buy and sell cryptocurrency on CEX, but in order to participate in trading on the exchange you already need verification. Thus, as I wrote above, if you just need to buy or sell crypto a couple of times, then CEX is quite suitable for you, but if you are a trader, then this exchange is clearly not the best exchange for you.

Main features of CEX:

- Only a few of the most popular cryptocurrencies are available.

- Operational tech. support.

- The average commission for trading is 0.25%.

- Mandatory identity verification to participate in trading on the exchange! You can buy or sell cryptocurrency one-time anonymously.

8. HitBTC is a proven international exchange.

This exchange is very good - it has been operating since 2013, during its operation it has gained a very significant number of users, and has also increased decent trading volumes.

There are also plenty of cryptocurrencies to choose from for trading, and most importantly, the commission for trading here is one of the lowest.

Among the minuses of the exchange, it is worth noting that the exchange does not work with fiat. That is, if you do not have cryptocurrency, then you will not be able to start working with this exchange - you will need to first buy a cryptocurrency somewhere, for fiat, and only then transfer the purchased cryptocurrency to HitBTC and only then you will be able to start trading. I would also like to mention that people often complain that trading on the stock exchange is “slow.” I myself have noticed similar “brakes” - the exchange often cannot cope with the load and begins to slow down.

Main features of HitBTC:

- One of the oldest international cryptocurrency exchanges.

- A large number of cryptocurrencies (more than 200) and new ones are being added.

- Operational tech. support.

- Low commission for trading - 0.07%.

- No identity verification is required and you can trade anonymously.

9. BitFinex is a large but expensive exchange.

I’ll answer right away why this platform is “expensive”: because to start trading on it you need to deposit at least $10,000 into your balance, and obviously the exchange is clearly not suitable for beginners and people who don’t have that amount.

But the lucky owners of $10,000 can bring it to the BitFinex exchange and appreciate all the delights of this trading platform - such as a simple and convenient interface, the presence of all the functions necessary for a trader and even a mobile application.

As for the reliability of this exchange, there are no questions here. The exchange has been operating since 2013 and has acquired a large number of users and good trading volumes, which is why it introduced such a limit of $10,000 for new traders, because the exchange already has enough users and apparently it doesn’t really need new ones.

Main features of BitFinex:

- The exchange has been translated into many languages, including Russian.

- A small number of the most popular cryptocurrencies are presented (about 20).

- 24/7 operational tech. support.

- No identity verification is required, but to activate your account you need to deposit $10,000 into your exchange balance.

10. YoBit is a good but bad exchange.

You are probably perplexed by the title - how is it that the exchange is good, but bad? Well - the YoBit trading platform at first glance is good from all sides - it has quite large trading volumes, a huge number of supported cryptocurrencies, and it is also well translated into Russian and even works with the QIWI payment system, which will undoubtedly be a big plus for traders from the CIS.

But there are two very big problems with this exchange - firstly, it receives quite a lot of complaints about account hacking and theft of funds from user accounts - such complaints come to absolutely all exchanges (since many people are illiterate and don’t know how protect your accounts from hacking), BUT there are noticeably more such complaints about the YoBit exchange than about any other exchanges, which suggests that the exchange is not very reliable.

And the second problem with YoBit is the sooooo slow tech. support, they answer about once a week, or even once every two weeks, and it doesn’t matter what problem you have - simple or serious, don’t hope that they will. support will respond to you earlier than a week after your request.

Thus, the exchange turns out to be quite good in terms of functionality, set of currencies, etc., but there are doubts about its reliability, and there is actually no technical support. support, so if you decide to trade on this exchange, it is at your own peril and risk.

I’ll add on my own that I personally worked with this exchange for more than four years and kept a decent amount of money on it and never had any problems, but in any case, I think it’s worth warning you that there are quite a lot of complaints about this exchange, so if you decide to If you work with it, it is better not to keep large sums on your account.

Main features of YoBit:

- The exchange has been translated into many languages, including Russian.

- A huge number of cryptocurrencies (more than 300) and new ones are being added.

- Very slow technical support.

- Low commission for trading - 0.2%.

- No identity verification is required and you can trade anonymously.

Which exchange to choose:

And so - above I have listed the 10 best crypto exchanges, among which each of you can find something to your liking, but if you still cannot decide how to choose the ideal cryptocurrency exchange for yourself and where to start, then I will try to give you advice :

If you want to earn money by trading cryptocurrency on the exchange - then you should definitely pay attention to the EXMO or LiveCoin exchange. These exchanges are far from the largest, but they are aimed at ordinary people and even a beginner can figure them out, and these exchanges also work with such fiat currencies as WebMoney, QIWI and Yandex. Money, which will be another plus for all traders from the CIS countries.

If you are not going to engage in trading, but just want to buy or sell cryptocurrency occasionally - then feel free to register on LocalBitcoins, there you can quickly and easily buy or sell cryptocurrency, for any fiat money you need, both electronic and from plastic cards of Russian/Ukrainian or other banks!

If you are new to the field of trading and you are interested in how you can start trading cryptocurrency, then everything is quite simple - first you need to choose the exchange on which you will trade (I think, having read what I wrote in the previous paragraphs of the article, you have already decided on choosing an exchange), and then you can start trading - the diagram of how to do this looks absolutely the same everywhere:

- Register on the desired exchange

- Replenish your account balance

- Go to the bidding section

- Buy/sell cryptocurrency

- Withdraw your earned money

But I think for most, the most difficult point is how exactly to make money trading cryptocurrency? And they make money on cryptocurrency in exactly the same way as on trading regular currency: you try to buy the cryptocurrency cheaper and then sell it at a higher price when the rate rises - it sounds very simple, but in order to become a good trader and earn a stable income from trading cryptocurrency, many people have to study for a very long time.

Therefore, in the video below you can familiarize yourself with a working strategy for making money on cryptocurrency exchanges, which even a novice trader can use:

How to protect your account on the exchange:

Why is this happening? Are all cryptocurrency exchanges really dishonest and periodically steal from users? No - there is no point in exchanges stealing from their own users, and such a large number of negative reviews is explained by the fact that:

- In general, only dissatisfied clients leave reviews for anything - after all, you must admit that if a person works on the stock exchange, everything is fine and there are no problems, then most likely he will not have the thought of going and leaving a positive review somewhere, that this The exchange is cool and good.

But if someone has problems with the exchange, then he immediately goes to write angry reviews on it wherever possible. Therefore, there are always more negative reviews than positive ones - even if the exchange is great, simply because no one usually writes positive reviews. - The vast majority of users are illiterate in matters of Internet security and do not understand how to protect their account on the exchange. Therefore, their accounts are easily hacked by hackers, and the exchanges are not at all to blame for this.

- Cryptocurrencies in most countries are still not recognized by law and from the point of view of legislation they are nothing and worth nothing - just “candy wrappers”, so if a hacker hacks your account on the exchange and steals cryptocurrency, then the police will not look for anyone (and even if they do) , then it’s almost impossible to find) because from the point of view of legislation, they just stole “candy wrappers” from you, not money.

Now let's move on to the most important thing - how to protect your account from hacking:

Enable Two Factor Authentication:

Be sure to install two-factor authentication using Google Authenticator on your exchange account and on the mailbox you use to work on exchanges.

For those who are not familiar with two-factor authentication, I’ll explain - you install a special application from Google on your smartphone, called “Google Authenticator” and link this application to your account on the exchange and to your mail:

After these steps, every time you log into your account on the exchange or your mail, you will be asked for an additional password, which is generated by the Google Authenticator application - thus, even if a hacker finds out your login and password from the exchange, he will not be able to get in to your account, because he will also need the password from the Google Authenticator application installed on your smartphone. Accordingly, only the owner of your phone will be able to access your account - that is, only you.

Do not “shine” your Login and Mail

Many people believe that a complex password is the most important thing to ensure that the account is reliably protected and forget about the importance of the login. After all, to get into your account you need to know not only the password, but also the login.

And it would seem that the login is always visible, how can you hide it? It’s very simple: come up with a separate unique login and mailbox for exchanges, and use this login and mailbox only on exchanges, and for forums, social networks. networks, etc. use a different login/mail.

This way, no one except you will know your name on the exchange - and if you don’t even know your login, then how to hack your account?

Create a complex Password

Do not use simple passwords like “qwerty” or your date of birth; they are very easy to guess, and it is also advisable to come up with a separate password for accounts on exchanges, which you will use only for working with exchanges and nowhere else.

Don't be fooled by Phishing and Viruses

The last point will be devoted to the human factor. A lot of hacking of accounts occurs due to the carelessness of people, for example - they send you a letter by email from the exchange on which you trade, asking you to change your account password, because... yours is outdated.

You follow the link from the letter to the exchange, enter your current login and password there, and then enter a new one (which you want to change to), and then it turns out that the letter that you received was not from the exchange at all, but from criminals and the site you went to and entered your username and password there is also not an exchange, but simply a site for collecting passwords that copied the design of the exchange 1 to 1. And just like that, you inadvertently gave your username and password to attackers.

The second is viruses. There are a huge number of viruses and they come in a wide variety of types, for example, you can install some “useful” browser extension for yourself, and then it turns out that this extension records all your actions and sends the passwords that you enter on sites to the creator of this extension.

In general, there are hundreds of examples of such tricks from criminals and it is impossible to list them all here, so to protect yourself, adhere to the following rules: do not follow dubious links, do not download or install dubious files and applications, and always carefully check the address of the site on which you enter your username and password - is this really a cryptocurrency exchange site or just a site that copied its design and collects passwords?

Well, that's all I wanted to tell you about the security of your account, I hope you learned that:

It is necessary to install two-factor authentication in an exchange account And on your mailbox This simple action will immediately protect your accounts from hacking by 99.9%. All the other techniques that I listed are not mandatory, but they can also help and increase the security of your funds.

Best Cryptocurrency Exchanges in Russian:

Almost all cryptocurrency exchanges are translated into several different languages, including Russian, so even if you don’t know a foreign language, you can work with any of them without any problems. But the translation on some exchanges leaves much to be desired - the creators of the site simply ran all the texts through Google Translator and that’s it. In general, of course, the translation turns out to be more or less understandable, but still very “crooked”.

It is also worth considering that not all crypto exchanges work with electronic money familiar to Russian people, such as QIWI or Yandex Money.

Below I have provided a list of exchanges that are well translated into Russian and also work with Russian currencies, so these exchanges are most convenient for users from Russia and the CIS countries:

| Name | High-quality translation | Supported currencies |

|---|---|---|

| The first and, quite possibly, the most convenient Russian-language crypto exchange is | Yes | WebMoney, QIWI, YAD |

| LocalBitcoins | Yes | WebMoney, QIWI, YaD, Bank Cards |

| LiveCoin | Yes | QIWI |

| YoBit | Yes | QIWI |

As you can see, the list of the most convenient cryptocurrency trading platforms in Russian is very small, because... Few exchanges target users from Russia, but I think the exchanges listed above should be enough for any trader.

Reliable cryptocurrency exchanges TOP-5:

And now I would like to talk a little about the reliability of cryptocurrency exchanges. Let us consider such a question as “official exchange”. The fact is that in the comments many people ask - is there any official or state-owned, most reliable cryptocurrency exchange? And the answer to this question is no.

There are no “official” or government-owned crypto exchanges. All currently operating cryptocurrency exchanges are private companies.

The fact is that in most countries of the world (including Russia), cryptocurrency is still very weakly regulated by law or is not recognized at all, and it is simply impossible to legally create some kind of state exchange.

Thus, absolutely all currently existing cryptocurrency exchanges are just private companies created by a specific person or group of people. Anyone reading this article can now hire programmers and create their own cryptocurrency exchange.

It turns out that if all exchanges are just private companies, how can we talk about their reliability? Here I will give a parallel - there is the Apple company, which is very large and famous throughout the world, and there is the Horns and Hooves company, registered somewhere in Cyprus - both of these companies are private, but it is obvious that the first is very reliable, and the second is not .

The reliability of a cryptocurrency exchange is determined in approximately the same way - they look at its popularity, trading volumes, user reviews, as well as who is the owner of the exchange and where the company is registered with this exchange. Obviously, the most famous, large exchanges, whose owners do not hide their identities, and whose company is registered in large countries, and not somewhere “in Cyprus,” are the most reliable.

Accordingly, I would present the TOP 5 reliable cryptocurrency exchanges as follows:

| Name | Popular | Owner known | Official company |

|---|---|---|---|

| 1. Binance | Yes | Yes | Eat |

| 2. BitMex | Yes | Yes | Eat |

| 3. KuCoin | Yes | Yes | Eat |

| 4. Huobi | Yes | Yes | Eat |

| 5. OKEx | Yes | Yes | Eat |

I would only like to add that, firstly, now there are at least several dozen cryptocurrency exchanges, which in my opinion are quite reliable (just if you list them all, the list will be huge), for example, the EXMO exchange meets all reliability criteria, but was not included in the list above, because it is less popular than the exchanges that were listed.

And secondly, you must understand that everything made by man is not ideal, and all cryptocurrency exchanges, as you probably guessed, were made by the same people as you and me, and people often make mistakes, so not a single exchange can give you have a 100% guarantee of reliability, simply because the programmer who created this exchange could, for example, make an error in the code and because of this error, hackers could then hack the exchange and withdraw all the users’ money from there.

Of course, any cryptocurrency exchange takes security very seriously and ensures the maximum protection of your funds - all code is checked 100 times by security specialists so that there are no errors and hacking does not happen, but in any case - as I said, everything what is made by man is not perfect, so no matter how large and reliable the exchange is, it still will not give you a 100% guarantee of the safety of your money.

If you are going to store a large amount of money on exchanges, then do not choose just one exchange, but distribute your funds across 5-10 different exchanges, so even if one of the exchanges is hacked, you will only lose a small part of your money.

Terms for a novice trader:

And I would like to make the last part of our article more exciting and distracted from money, ratings and security.

Almost every popular cryptocurrency exchange has its own chat where users can freely communicate with each other - share ideas, news, etc. And most traders, when communicating in a chat, use professional slang, which most likely will be incomprehensible to a beginner. Therefore, so that when you start trading on the stock exchange, you don’t feel like a black sheep and understand what others are talking about, let’s look at the basic terms that you can hear in exchange chats:

Bull market- this is a situation when the price of a currency pair is rising and other traders are strengthening this trend by actively purchasing currency.

Volatility - a characteristic reflecting the rate of change in the price of a specific cryptocurrency per unit of time. For example, if the price of Bitcoin increased by 20% in a day, then we can say that Bitcoin showed high volatility today.

Dump- from the English Dump (reset). A decrease in the price of cryptocurrency due to the fact that it began to be actively sold.

Whales- major players in the market who own a lot of money and are able to influence the market.

Correction- temporary movement of the currency price in the direction opposite to the current trend. For example, if the price of Bitcoin rose 10% and then fell 5%, then we can say that there was a 5% correction.

Elk- from the English word loss (loss). Indicates a bad deal (loss of funds). For example, you can say “I caught a moose today,” that is, I made a bad deal and lost money.

Bear market – this is a situation when the price of a currency pair is declining and other traders are strengthening this trend by actively selling the currency.

Order- an application put up for auction to buy or sell cryptocurrency.

Pump- from the English Pump (pumping). An increase in the price of cryptocurrency due to the fact that it began to be actively bought.

Hamster- a beginner who understands little about cryptocurrency trading.

These are the basic terms that I could remember - if you come across any other terms that you do not understand, then do not hesitate to ask in the comments. Also, do not be afraid to ask any questions regarding crypto exchanges and working with them - I will try to answer everyone.

Every experienced cryptocurrency user understands well that cryptocurrency exchanges are the best option for exchanging regular money for digital coins and one cryptocurrency for another. If compared with, then thanks to crypto exchanges it is possible to reduce the exchange commission several times, not to mention the traders for whom the exchanges provide rich functionality for trading. Next, we will consider the most important criteria for choosing an exchange, the best cryptocurrency exchanges themselves in 2018, and also provide valuable recommendations for their use. I also ask you to write in the comments your thoughts and experiences about which cryptocurrency exchange is the best in your opinion.

How to choose a reliable crypto exchange? Main criteria

What is a cryptocurrency exchange? To determine the most suitable and reliable crypto exchange for you, you should pay attention to the following important points.

— What currencies does the exchange support, how many of them, which ones do you need.

— What coins do you mine, if you are engaged in mining.

— Does the exchange work with fiat money, dollars, rubles, hryvnia.

— The presence of hidden payments, secret commissions, the commissions themselves for replenishment, trading operations, for withdrawing cryptocurrency or fiat.

— How quickly operations occur.

Next, based on all these parameters, we will consider the most popular, proven and reliable resources where you can buy, sell and exchange your cryptocurrencies or fiat money for cryptocoins.

Rating of cryptocurrency exchanges regarding trading volumes and popularity

1. Binance

This is a young exchange that began its work back in 2017. After a successful ICO, during which the internal tokens of the BNB exchange grew more than 10 times, this crypto exchange quickly entered the TOP 5 of all cryptocurrency exchanges in the world in terms of trading volumes. The headquarters of the Binance exchange is located in Hong Kong, which provides much greater reliability than the jurisdictions of other similar competing exchanges. The main advantages of the Binance service are low commissions, no need to verify and send personal documents, simple interface, a huge number of currency pairs (more than 600 coins). Binance().

This exchange has been operating since 2013 and is very popular among users from the CIS countries and beyond. The service works with fiat - you can replenish your account and withdraw funds using electronic payment systems and bank cards. The site works with 17 trading pairs, commissions per transaction are 0.2%. You can find conflicting reviews about this site online; most users recommend using the site as an exchanger and not storing their funds on it for a long time. Exmo

3. Bitmex

The first cryptocurrency exchange with leverage. A detailed overview and all the advantages of the Bitmex platform can be found by clicking on.

4.Localbitcoins

One of the most reliable and popular platforms in the CIS, for review.

5. Kraken

Another very large exchange that is very popular all over the world. The organization itself was founded in San Francisco, the exchange has been operating since 2011. It features a high level of reliability and safety. The standard commission for transactions is 0.2%; as trading turnover increases, it decreases. Also here you can find a large number of pairs for trading, works with fiat - you can replenish your account and withdraw money using bank transfers.

6. Bitfinex

A large foreign exchange that supports the Russian language. Initially, the service was positioned as a platform for buying and selling bitcoins, but later many other crypto coins began to appear here. It is possible to replenish and withdraw funds from a bank card - not only in dollars, but also in many other fiat currencies. The exchange has its own applications for mobile devices on iOS and Android, so you can perform trading operations directly from your phone or tablet.

7. Bittrex

This is another foreign and very popular online platform for exchanging cryptocurrencies all over the world. Features a large number of trading pairs, work with fiat money,

high level of reliability. The main work of the site is tied to bitcoins - all exchange conversion operations and even transfers to fiat are tied specifically to BTC coins. Many obscure coins can be found here. The exchange interface is more suitable for experienced traders than for beginners.

8. LiveCoin

Another popular project with Russian language support. The site works with a large number of currency pairs - more than 200, and is distinguished by rich functionality for trading. Transaction fees range from 0.1–0.2%. Works with such popular EPS as Payeer, PerfectMoney, as well as bank transfers. On the site you can communicate with support in Russian. Livtcoin ().

9.YoBit

Another very popular exchange, which is famous for supporting a large number of coins and ease of use. In addition, here you will find many other convenient features for trading and investing in cryptocurrencies. There is support for the Russian language, low commissions, the opportunity to invest rubles and dollars - the exchange works with fiat money, accepts transfers from EPS and bank cards. The number of supported trading pairs is more than 400 coins. Yobit ().

10. AlienCloud

A relatively young, but ambitious, rapidly developing Aliencloud exchange. It has a number of advantages among its competitors, such as:

— The lowest commissions for trading 0.02% -0.09%,

— High liquidity for all pairs,

— Daily turnover over 30 mln USD.

In addition to all this, exchange users can not only store, exchange and trade cryptocurrency, but also rent capacity for. With full functionality and a detailed overview of the exchange AlienCloud can be found by clicking on.

Choosing a cryptocurrency exchange: what is important to pay attention to?

Today on the Internet you can find a large number of platforms for trading cryptocurrency, as a result of which beginners may have difficulty choosing a suitable resource. Below we will list the main factors that will help you make your choice.

1) Daily trading volumes

Naturally, one of the most determining parameters of any crypto exchange is its trading volume. This indicator can also be used to determine the hype regarding a specific currency pair with the ability to predict its future exchange rate movement.

2) Deposit and withdrawal of money

Before registering on any resource, it is important to look at which payment systems cooperate with this site. Thus, even moderately successful trades may not be profitable due to high commissions when depositing or withdrawing funds. This is also important for miners who exchange their cryptocurrencies for fiat. Typically, the most convenient options for depositing and withdrawing funds to the exchange will be the following methods: WebMoney; QIWI; Yandex money; bank transfers.

3) Cryptocurrency pairs

Naturally, the number of cryptocurrencies supported by a particular resource directly affects its relevance and popularity among users. After all, no one wants to work with a coin that is not on any of the top exchanges. If a crypto exchange supports not 10–20, but 200 or more cryptocurrencies, then it will be much more convenient for you to purchase the necessary coins, including rare cryptocurrencies. It is also important that the same bitcoin can be exchanged not only for other coins or dollars, but also for rubles, hryvnias and more.

4) Monitoring by courses

If you are involved in trading, then you have probably heard about such a trading strategy as arbitrage between exchanges. As a result, it makes sense to track rates on various resources in order to determine the differences between rates for the rapid exchange of currencies between exchanges. It won't bring you a lot of money, but you will get extra income.

5) No need to download computer software

The absence of any special scripts or programs to get started should be taken as an advantage, since you should not download any applications to your computer from dubious and little-known resources.

Choosing the best cryptocurrency exchange in 2018, reviews from traders and miners

There is no doubt that cryptocurrency exchanges play a huge role in the development of the crypto-economy, but it is worth understanding that it is not worth storing money on such resources for the long term. According to statistics, more than 50% of crypto exchanges have been hacked, so if there is a need to store money on an exchange for trading, then you should use several resources. And it is better to withdraw large amounts of funds to cold storage crypto wallets. You definitely shouldn’t trust resources that require you to enter cryptocurrency with the promise of multiplying your investments many times over, or promising free cryptocurrency, huge bonuses, and requiring you to install software for your computer. If you have experience working with the cryptocurrency exchanges described above or would like to leave your feedback, then write it in the comments to this article.